Why Recycling Programs Fail (Even When People Care)

- Darn

- May 16, 2025

- 5 min read

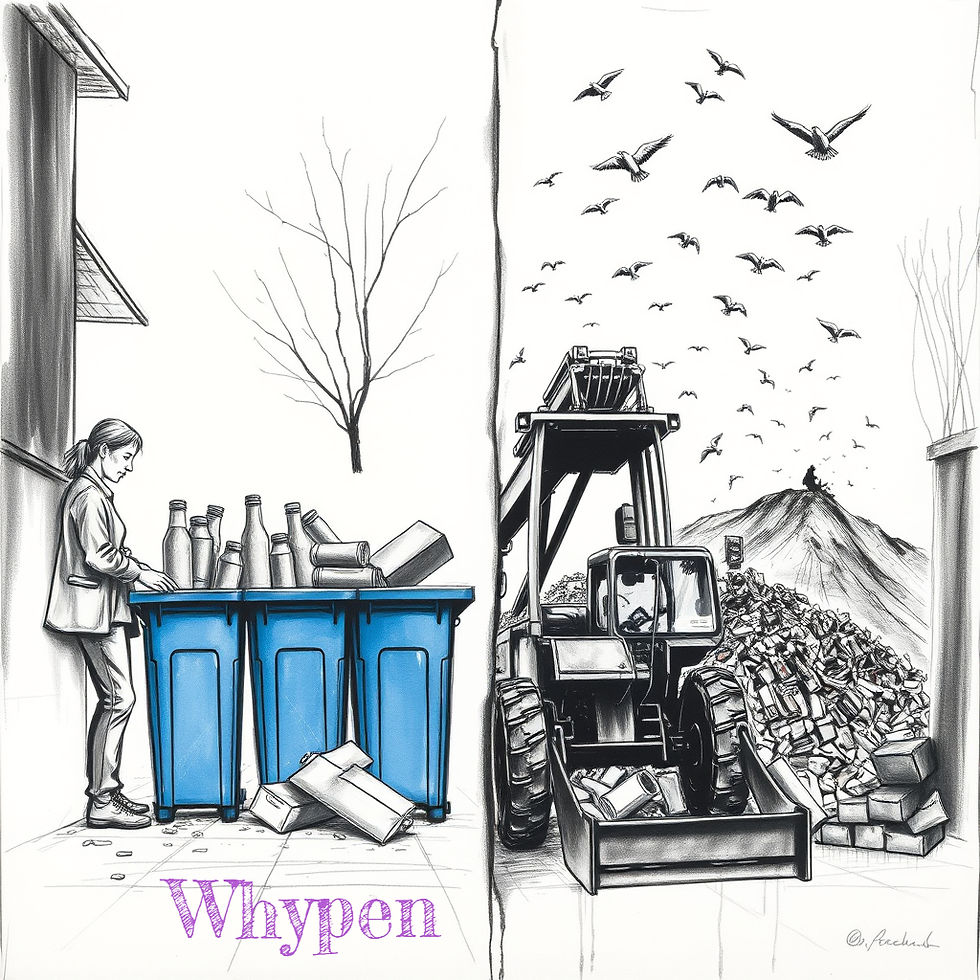

Recycling fails not because people don’t care, but because the system keeps acting like a used-car lot - good promises, dodgy parts, and a price that changes the moment you drive away.

1. Good Intentions, Grim Math

American curbside bins overflow with earnest blue arrows, yet the U.S. national recycling rate is still stuck at ≈32 % - and that figure is six years old because EPA hasn’t finished updating its numbers. According to US EPA, plastic is the punch line: a 2024 update from Beyond Plastics pegs the true plastic recycling rate at just 5 %, down from 8.7 % in 2018.

Europe does better but far from perfect. The EU averages 49 % for household packaging, while Germany waves the championship belt at 68-69 %, depending on how you count composite packaging.

In Kenya, new Extended Producer Responsibility (EPR) rules promise to raise domestic capture rates, yet the country still ships much of its collected plastic abroad or dumps it in Dandora, Africa’s largest landfill.

Bottom line: the feel-good slogans outpace the arithmetic.

2. Wish-Cycling & Contamination: When the Right Thing Goes Wrong

Eighty-two percent of UK households add at least one non-recyclable item to their recycling each week; average contamination entering British material-recovery facilities (MRFs) is 16.6 %. The Guardian notes that winter makes it worse: soggy cardboard fused to plastic raises contamination by 40 % between November and March, sending an extra 5 000 t of material straight to landfill or incinerators. The U.S. story is similar. The Recycling Partnership’s 2024 “State of Recycling” found that only 21 % of curbside-collectible recyclables actually make it through the system.

Contamination costs money. Every mis-sorted pizza box drags down commodity prices, and MRFs either pass the bill to municipalities or quietly ship bales to Southeast Asia. Consumers think they’re helping; processors mutter about “wish-cycling” as they shovel out wet diapers.

3. Market Mayhem: When Values Swing Harder Than Bitcoin

Recycling is ultimately a commodities business, and 2024 looked like a roller coaster built from corrugated cardboard. Old corrugated container (OCC) prices leapt from ≈$29 /t in late 2022 to over $107 /t by mid-2024, before tapering again in early 2025. Mixed paper went from negative value (“please-take-it”) to $70 /t, then slid as domestic mills throttled back.

Plastic prices are even more volatile because they track oil. When crude tanks, virgin resin is cheap and nobody wants your painstakingly sorted PET. The result: bales languish, contracts collapse, and cities like Philadelphia quietly send recyclables to landfills for a month “until markets improve.”

4. Cheap Landfills, Expensive Bins

Economists love the phrase “price signals,” but most U.S. landfills still charge under $70 /t—barely higher than the fee in 1995 after inflation. One Colorado county just raised tipping fees from $58 to $69 /t and still sits below the full cost of curbside recycling collection in many rural areas. When burying trash remains the bargain option, councils faced with tight budgets slash recycling days, close drop-off depots, or eliminate glass because it “doesn’t pay for itself.”

Contrast that with Germany, where landfill bans on untreated municipal waste and high incineration taxes drove recyclers to innovate—helped along by a deposit-return scheme that captures >98 % of PET bottles and keeps feedstock clean. (No wonder German curbside contamination rates are falling even as overall volumes tick up.).

5. Policy Gaps & Producer Power

Remember China’s National Sword? Beijing slammed the gate on contaminated imports in 2018, and by 2024 researchers found it had cut global scrap-plastic trade by about one-third and slashed China’s own imports 30 %. Rich countries scrambled to build domestic capacity but mostly shipped the problem to Malaysia, Thailand, or Indonesia until those nations started drafting bans of their own.

Extended Producer Responsibility (EPR) aims to fix the incentive mismatch by billing brands for the mess. Kenya’s 2024 regulations mirror EU directives: producers must finance recovery and prove recycled content. India’s stricter EPR rules are propelling a plastic-credit market projected to hit $1.7 bn by 2030, even as companies complain they can’t find enough recycled resin to meet the mandate.

The U.S. remains a patchwork: four states (ME, OR, CO, CA) passed EPR laws for packaging by 2025, but Congress stalled on nationwide rules. Without uniform targets, brands design packaging for marketing, not material recovery.

6. Data Black Holes

EPA openly admits it lacks current, consistent numbers; its 2024 infrastructure assessment highlights “serious data gaps” in both material flows and public spending. f you can’t measure capture rates by material and by zip code, it’s hard to optimize truck routes, invest in optical sorters, or prove ROI for upgraded plants. Even Germany’s lauded system is grappling with up to 40 % mis-sorted waste in ostensibly “clean” streams, according to its environment agency.

7. Human Behaviour Meets System Design

People want to recycle: surveys routinely show support above 70 %. Yet nearly half of newly built U.S. apartment complexes still lack adequate chute separation or on-site education. When signage is tiny, bins overflow, and pick-ups are irregular, the most conscientious tenant will shrug and toss everything down the trash shoot.

Conversely, Wales leads the UK league tables at ≈57 % household recycling thanks to weekly food-waste caddies, clear labeling, and fines for the chronically careless. Scotland is preparing similar stick-and-carrot tactics: council staff now sift bins and issue penalties for serial offenders. Social norms matter, but only after infrastructure does its job.

Where the Wheels Fall Off and How to Keep Them On

Failure Mode | What It Looks Like | How to Fix It |

Dirty stream | Pizza-box grease ruins a $70 t paper bale | Standardized labels + curb-side audits; invest in optical sorters |

Commodity crash | PET price < cost of baling | Minimum-recycled-content laws stabilize demand |

Cheap dumping | $60 landfill vs $95 curbside program | Raise landfill tipping fees; levy incineration taxes |

Data desert | Cities quote 2018 numbers in 2025 | National reporting mandates & barcode-based tracking |

Producer escape hatch | Non-recyclable multilayer pouches | EPR fees tied to real end-of-life costs; design-for-recycling guidelines |

Spoiler alert: None of these fixes rely on more motivational posters about saving the planet. They rely on finance, engineering, regulation—and yes, a dash of marketing.

The Road Ahead

Recycling will keep failing whenever it tries to out-compete landfill on a tilted playing field, audit contamination with microscopes, or rely on commodity prices that dance the Macarena. But it can work when we:

Bill the right party. If packaging is impossible to recycle, charge the brand until redesign becomes cheaper.

Price the wrong choice. Make landfill the wallet-stinger and watch diversion climb.

Clean the feedstock. Standard labels, deposit systems, and weekly food-waste collection reduce contamination faster than PR campaigns.

Close the data gap. Barcode every bale, publish live dashboards, and let investors see which towns deserve cheaper bond rates for doing it right.

Secure markets. Minimum-content mandates guarantee offtake even when oil prices whiplash.

People already rinse the jars. The ball is in the court of policymakers, producers, and processors to build a system that doesn’t turn good intentions into landfill layers.

Because if we don’t fix the machinery, earnest citizens will keep playing eco-roulette and the house always wins.

$50

Product Title

Product Details goes here with the simple product description and more information can be seen by clicking the see more button. Product Details goes here with the simple product description and more information can be seen by clicking the see more button

$50

Product Title

Product Details goes here with the simple product description and more information can be seen by clicking the see more button. Product Details goes here with the simple product description and more information can be seen by clicking the see more button.

$50

Product Title

Product Details goes here with the simple product description and more information can be seen by clicking the see more button. Product Details goes here with the simple product description and more information can be seen by clicking the see more button.

Comments